Stock Market Performance Under 25 U.S. Presidents

The U.S. stock market is often a reflection of broader economic conditions, investor sentiment, and government policies. Below is an analysis of how the market performed under U.S. presidents, focusing on their time in office, key achievements, and the stock market’s starting value, high point, low point, and overall performance.

Franklin D. Roosevelt (1933–1945)

Time in Office: 12 years, during the Great Depression and World War II.

About the President: Architect of the New Deal, which aimed to revive the U.S. economy.

Market Performance:

- Starting Value: DJIA at 66.

- High Point: 152.

- Low Point: 50 in 1938.

- Performance: +93% growth during his tenure.

Harry S. Truman (1945–1953)

Time in Office: 8 years, post-World War II.

About the President: Known for the Marshall Plan and the Korean War.

Market Performance:

- Starting Value: DJIA at 152.

- High Point: 293.

- Low Point: 161.

- Performance: +93% growth.

Dwight D. Eisenhower (1953–1961)

Time in Office: 8 years, during a period of economic prosperity.

About the President: Promoted infrastructure growth with the Interstate Highway System.

Market Performance:

- Starting Value: DJIA at 293.

- High Point: 679.

- Low Point: 280.

- Performance: +132% growth.

John F. Kennedy (1961–1963)

Time in Office: 3 years (assassinated in 1963).

About the President: Advocated for economic stimulus and tax cuts.

Market Performance:

- Starting Value: DJIA at 679.

- High Point: 732.

- Low Point: 576.

- Performance: +8% growth.

Lyndon B. Johnson (1963–1969)

Time in Office: 6 years.

About the President: Launched the “Great Society” and expanded civil rights.

Market Performance:

- Starting Value: DJIA at 732.

- High Point: 985.

- Low Point: 735.

- Performance: +34% growth.

Richard Nixon (1969–1974)

Time in Office: 5 years (resigned in 1974).

About the President: Focused on foreign policy but faced economic challenges like stagflation.

Market Performance:

- Starting Value: DJIA at 985.

- High Point: 1,052.

- Low Point: 577.

- Performance: -41% decline.

Gerald Ford (1974–1977)

Time in Office: 3 years.

About the President: Tackled post-Watergate economic challenges.

Market Performance:

- Starting Value: DJIA at 577.

- High Point: 1,005.

- Low Point: 577.

- Performance: +74% growth.

Jimmy Carter (1977–1981)

Time in Office: 4 years.

About the President: Struggled with stagflation and energy crises.

Market Performance:

- Starting Value: DJIA at 1,005.

- High Point: 1,024.

- Low Point: 740.

- Performance: -0.5%.

Ronald Reagan (1981–1989)

Time in Office: 8 years.

About the President: Implemented Reaganomics—tax cuts and deregulation.

Market Performance:

- Starting Value: DJIA at 950.

- High Point: 2,235.

- Low Point: 776.

- Performance: +148% growth.

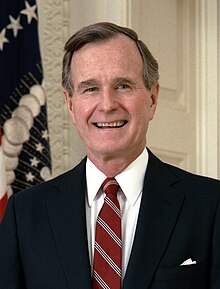

George H.W. Bush (1989–1993)

Time in Office: 4 years.

About the President: Oversaw the Gulf War and a mild recession.

Market Performance:

- Starting Value: DJIA at 2,235.

- High Point: 3,413.

- Low Point: 2,365.

- Performance: +47% growth.

Bill Clinton (1993–2001)

Time in Office: 8 years.

About the President: Presided over a tech-driven economic boom.

Market Performance:

- Starting Value: DJIA at 3,413.

- High Point: 10,587.

- Low Point: 3,391.

- Performance: +210% growth.

George W. Bush (2001–2009)

Time in Office: 8 years.

About the President: Faced 9/11 and the 2008 financial crisis.

Market Performance:

- Starting Value: DJIA at 10,587.

- High Point: 14,164.

- Low Point: 6,547.

- Performance: -25%.

Barack Obama (2009–2017)

Time in Office: 8 years.

About the President: Focused on recovering from the Great Recession.

Market Performance:

- Starting Value: S&P 500 at 805.

- High Point: 2,271.

- Low Point: 676.

- Performance: +166%.

Donald Trump (2017–2021)

Time in Office: 4 years.

About the President: Implemented tax cuts and faced the COVID-19 pandemic.

Market Performance:

- Starting Value: DJIA at 19,827.

- High Point: 31,188.

- Low Point: 18,591.

- Performance: +57%.

Joe Biden (2021–Present)

Time in Office: Ongoing.

About the President: Focused on infrastructure and stimulus amid inflation.

Market Performance:

- Starting Value: S&P 500 at 3,798.

- High Point: 4,800.

- Recent Trend: Adjusting to inflation and rate hikes.

Observations From Over Four Decades Across Presidencies

Strong Performers: Franklin D. Roosevelt and Ronald Reagansaw some of the biggest percentage increases in the stock marketbecause the country emerged from deep recessions with large-scaleeconomic reforms.

Effects of Crises: Other presidents facing economic crisis (Herbert Hoover in the Great Depression, George W. Bush in the 2008 financial crisis) suffered market performance during their presidencies.

Modern Markets: These days, markets are increasingly being driven by technology booms, monetary policy and global trade dynamics, as opposed to the old-fashioned gains of industrialists, as seen under the administrations of Obama, Trump and now Biden.

Conclusion

A stock market performance under any president is as much a snapshot of prevailing economic conditions as it is the result of their policies — no one administration can single-handedly dictate market outcomes. Federal Reserve policy, global events, and technological progress usually have more direct influence. Market trends should be viewed through decades, not successive presidencies – especially considering that they can be used as scapegoats when things take a wrong turn.